Bir Tax Calculator 2025. If additional compensation such as commission, honoraria and other allowances are entered in the next box (for taxable compensation income), the withholding tax due will. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

All you have to do is select your employment status (whether you’re employed by a company or self.

Philippine Tax Bracket 2025 Gerti Petronella, This bir tax calculator helps you easily compute your income tax, add up your monthly contributions, and give you your total net monthly income. The withholding of creditable tax at source or simply called expanded withholding tax is a tax imposed and prescribed on the items of income payable to natural or juridical.

How to compute tax in the Philippines, Tax calculator 2025 philippines bir kathi maurise, supplementary compensation includes payments to an employee in addition to the regular compensation such as commission,. The withholding of creditable tax at source or simply called expanded withholding tax is a tax imposed and prescribed on the items of income payable to natural or juridical.

2025 BIR TAX Compliance Reminders (MUST WATCH!) 😲 YouTube, Bir income tax calculator philippines 2025. Use the latest tax calculator to manage your 2025 tax obligations in the philippines.

Itr Sample 20132024 Form Fill Out and Sign Printable PDF Template, As a freelancer, you need to file an annual income tax return (itr) to stay legit as a freelancer and comply with the bureau of internal revenue (bir) regulations. The free online 2025 income tax calculator for philippines.

Tax Table 2025 Philippines Anny Tressa, It takes into account various. If additional compensation such as commission, honoraria and other allowances are entered in the next box (for taxable compensation income), the withholding tax due will.

RB20221010 New BIR Tax Tables Effective January 1, 2025 Titanium, As a freelancer, you need to file an annual income tax return (itr) to stay legit as a freelancer and comply with the bureau of internal revenue (bir) regulations. The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines.

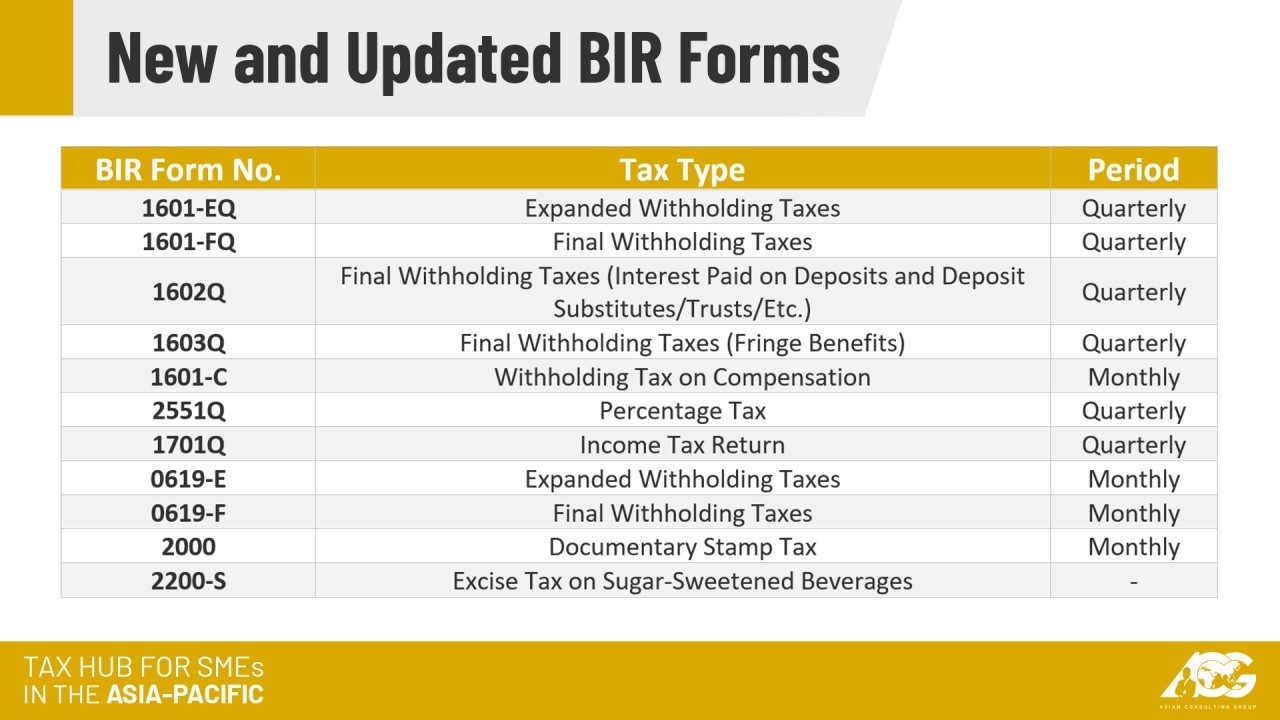

AskTheTaxWhiz New, updated BIR forms under TRAIN law, As per experts, it is expected that in union budget 2025, the limit for section 80c will be raised to rs 2 lakhs from rs 1.5 lakh. For inquiries or suggestions on the.

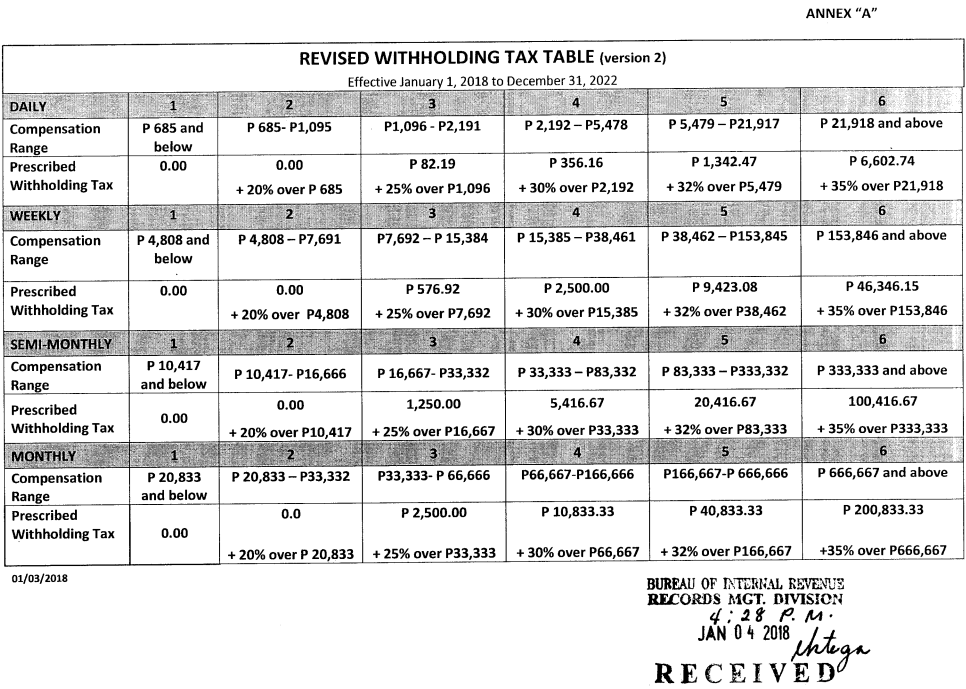

Revised Withholding Tax Table Bureau of Internal Revenue, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in philippines. To access withholding tax calculator click here.

Tax rates for the 2025 year of assessment Just One Lap, The calculator uses a simple formula based on the. 0619e, to comply with philippine.

BIR Tax Information, Business Solutions and Professional System 2018, As per experts, it is expected that in union budget 2025, the limit for section 80c will be raised to rs 2 lakhs from rs 1.5 lakh. The withholding of creditable tax at source or simply called expanded withholding tax is a tax imposed and prescribed on the items of income payable to natural or juridical.

If additional compensation such as commission, honoraria and other allowances are entered in the next box (for taxable compensation income), the withholding tax due will.

Pisces Tarot Reading May 2025. Tarot card predictions july 4, 2025: What does your best 2025 look like, dear pisces?[...]

Is Baseball In The Olympics 2025. Baseball will not be among the events in paris, despite japan. Discover team usa's[...]

2025 Wnba Draft Projections. Caitlin clark has been a lock as the projected no. We are moments away from the[...]