403 B Contribution For 2025. The total combined contributions to a 403b plan in 2025 cannot exceed the lesser of: The 2025 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions.

This calculator is meant to help you determine the maximum elective salary deferral contribution you may make to. 100% of the employee’s includible compensation for the year, or.

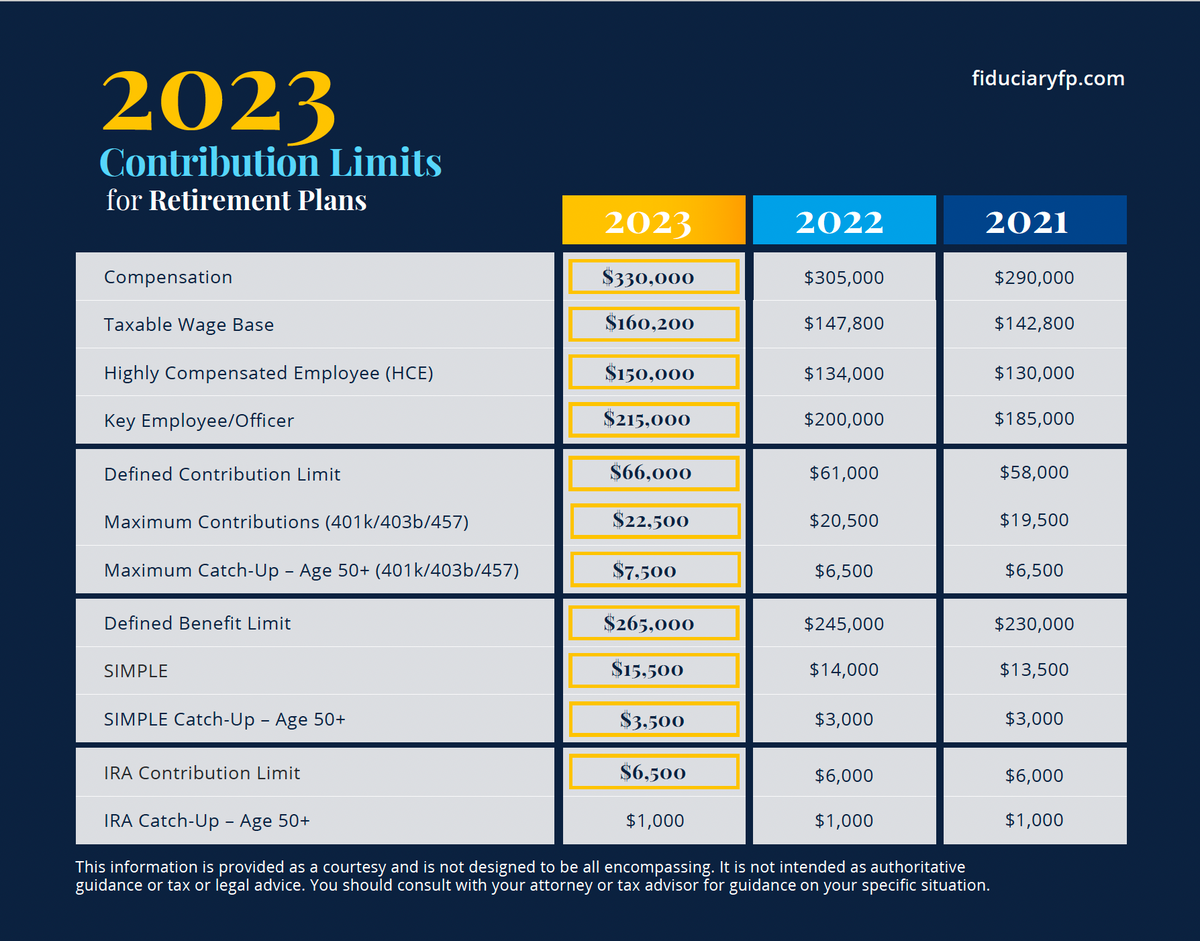

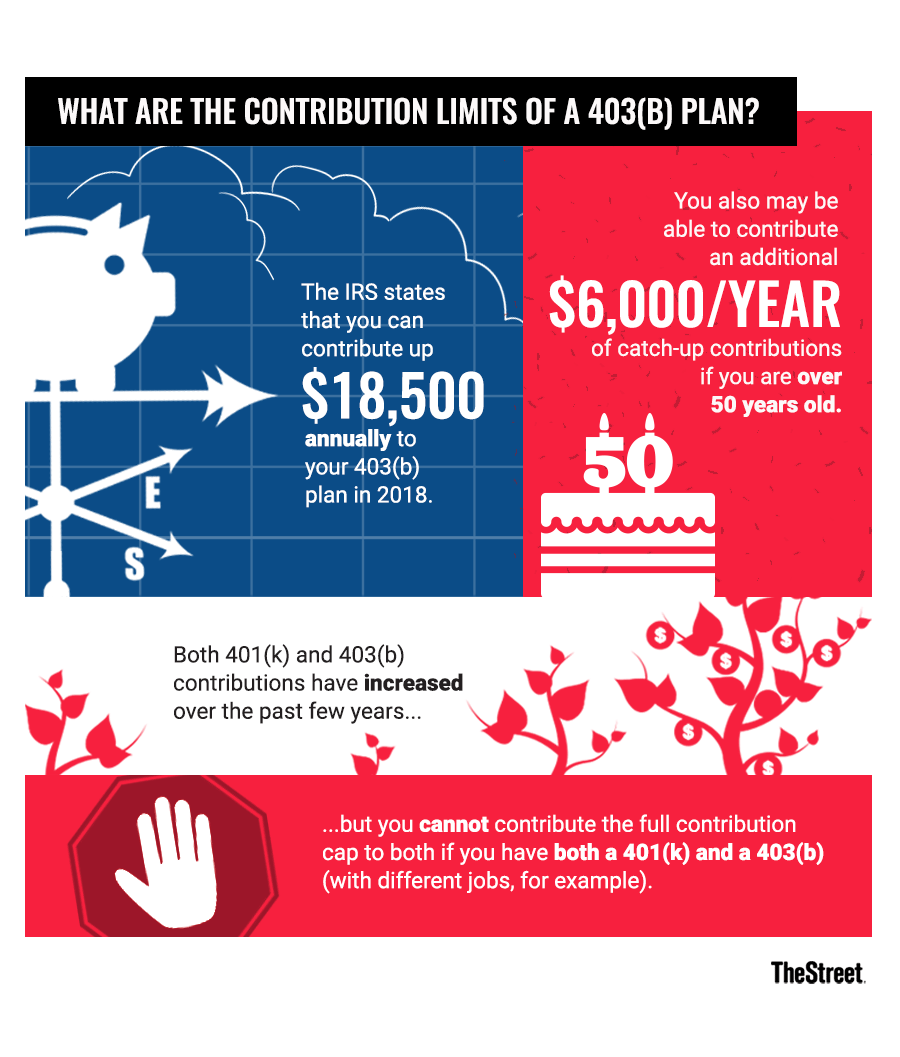

Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

The 2025 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions.

403(b) Contribution Limits for 2025, 100% of the employee's includible compensation for the year, or. 403(b) contribution limits in 2025 and 2025.

2025 403b Limit Jane Roanna, The 2025 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions. The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025.

What Is a 403(b) Plan and How Do You Contribute? TheStreet, 100% of the employee's includible compensation for the year, or. Under the 2025 limits, the 403(b) retirement plan maximum contribution, as an elective deferral, is $23,000.

The Benefits of a 403(b) Retirement Plan SDG Accountants, Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation. Your contribution and your employer’s contributions.

403(b) Contribution Limits for 2025, The 403(b) contribution limit refers to the maximum amount that an individual can contribute annually to their 403(b) retirement savings plan. Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

403(b) Plan Workest, Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation. This is the limit across all 403 (b).

403(b) Contribution Limits For 2025 And 2025, However, if you are at least 50 years old or older, you. Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

_vs._457(b).png?width=960&height=540&name=403(b)_vs._457(b).png)

The Beginners Guide To Understand 403 B Plan Overview CC, Workers can contribute up to $23,000 of their income to a 403 (b) plan, with an additional $7,500 allowed for workers 50 and older. However, if you are at least 50 years old or older, you.

403(b) vs 457(b) Eligibility, Process & Contribution Comparison, Workers can contribute up to $23,000 of their income to a 403 (b) plan, with an additional $7,500 allowed for workers 50 and older. For 2025, employees could contribute up to $22,500 to a 403 (b) plan.

401(k) Contribution Limits in 2025 Meld Financial, This is the total amount that you can contribute to your 403(b) plan from your salary before taxes. If you're 50 or older, you can contribute an.

Contribution limits for 403(b)s and other retirement plans can change from year to year and are adjusted for inflation.

Angela Bassett Grammy 2025. Angela bassett, collecting an honorary oscar, gave an impassioned speech about the history of black actresses[...]

Worlds Schedule 2025 Cheer. The 2025 the cheerleading worlds broadcast starts on apr 26, 2025 and runs until apr 29,[...]

Top Songs In Tanzania 2025. Tanzanian top 100 chart lists the best performed music videos measured on a daily basis.[...]